what is suta tax rate for california

Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025. The new employer SUI tax rate remains at 34 for 2020.

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

For example the wage base limit in California is 7000.

. The new-employer tax rate will also remain stable at 340. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. 350 x 3 1050.

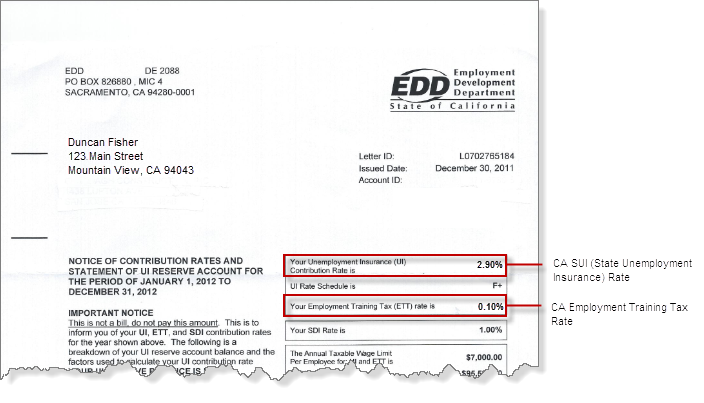

What is the amount of. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. Additionally positive-rated employers and new employers are to be assessed an employment training tax of 01 for 2021 unchanged from.

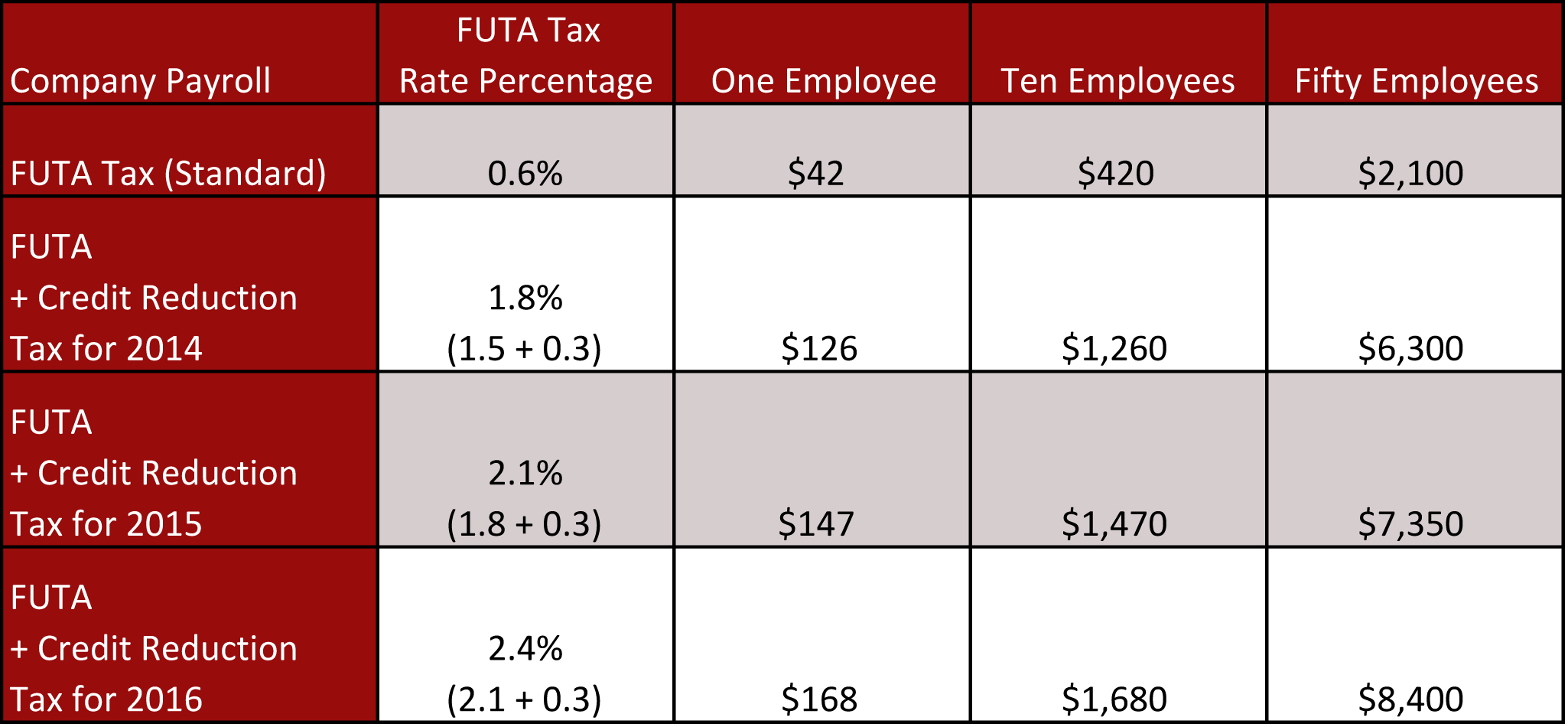

The first 7000 for each employee will be the taxable wage base limit for FUTA. Effective January 1 2022 unemployment tax rates will hold steady as compared to 2021 ranging from 150 to 620. The SUI taxable wage base for 2020 remains at 7000 per employee.

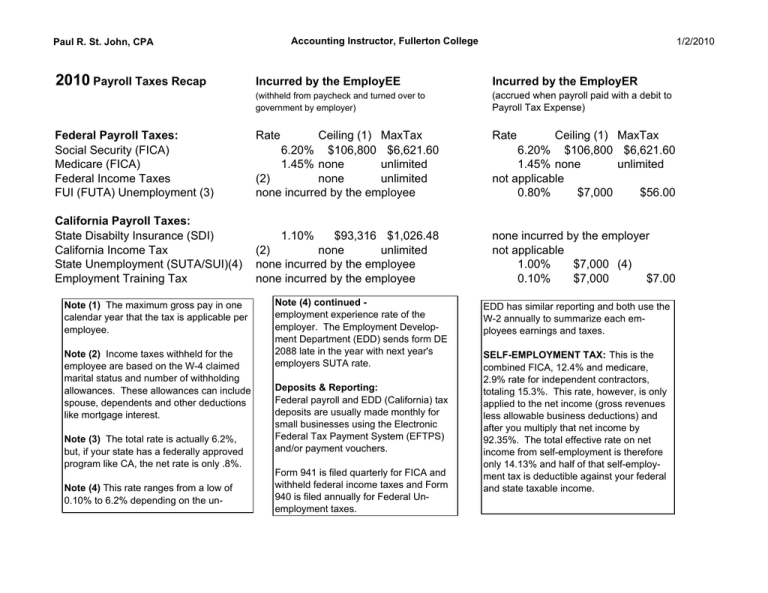

Standard rate 257 207 employer share. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Federal Unemployment Tax Act FUTA FICA. In 2018 the trust fund regained a positive balance after nine years of insolvency.

Here is how to do your calculation. Under FUTA f ederal unemployment tax rates are six percent taken on each of your employees first 7000 in wages. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

In California you are liable for UI taxes once youve paid more than 100 in wages in a calendar year. 5 of 7000 350. You have an employee who makes 45000 a year.

2020 SUI tax rates and taxable wage base. SUTA dumping is also referred to as state unemployment tax avoidance and tax rate manipulation. If for some reason we happen to leave a mistake unnoticed you are invited to request unlimited revisions of your custom-written paper.

The tax rate for new employers is to be 34. State SUTA new employer tax rate Employer tax rate range SUTA wage bases Alabama. 1 2021 unemployment tax rates for experienced employers are to be determined with Schedule F and are to range from 15 to 62.

The True Cost Of Hiring An Employee In California Hiring True Cost California. 065 68 including employment security assessment of 006 8000 Alaska. How to apply for a SUTA account Are you a new employer.

Most states send. SUTA State Unemployment Tax Act dumping one of the biggest issues facing the Unemployment Insurance UI program is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low UI tax rates. For example if you have eight employees and you pay all of them at least 45000 per year you only need to pay the FUTA tax rate on 56000 total eight employees multiplied by the 7000 FUTA cap.

You will pay 1050 in SUI. New Hampshire has raised its unemployment tax rates for the second quarter of 2020. State unemployment tax rates.

Rules for UI Tax Liability. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the. Californias unemployment tax rates and wage base are not to change in 2022 while the state disability insurance wage base is to rise the state Employment Development Department said Oct.

No guidance yet. For example the SUTA tax rates in Texas range from 031 631 in 2022. The new employer SUI tax rate remains at 34 for 2021.

The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. 050 employee share 15 59.

The new employer SUI tax rate remains at. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. 52 rows The tax rates are updated periodically and might increase for businesses in certain industries.

You could pay up to 102375 in SUTA taxes per employee with your new employer construction rate 0975 x 10500. Do not include dollar signs commas decimal points or negative amount such as -5000. Once you know these you can do the calculation.

The current FUTA tax rate is 08 and the SUTA tax rate is 54. State unemployment tax is a percentage of an employees. 1 2022 the unemployment-taxable wage base is to be 7000 the department said on its website.

This is unlike many other states which follow the federal rules for UI tax liability under the Federal Unemployment Tax Act FUTA or very similar rules. FUTA Tax Rates and Taxable Wage Base Limit for 2021. 52 rows You may receive an updated SUTA tax rate within one year or a few years.

Using the formula below you would be required to pay 1458 into your states unemployment fund. This calculator does not figure tax for Form 540 2EZ. 4 rows Imagine you own a California business thats been operating for 25 years.

The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. The tax rate for new employers is 17. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27.

Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. Since the wage base in New York for 2021 was 11800 your tax payment for your worker would be 004025 times 11800 for the year or. Tax rates for the second quarter range from 01 to 17 for positive-rated employers and from 33 to 75 for negative-rated employers.

9000 taxable wage base x 27 tax rate x 6 employees 1458 SUTA taxes.

Our Company Is Agricultural And Not Required To Pa

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

What Is Sui State Unemployment Insurance Tax Ask Gusto

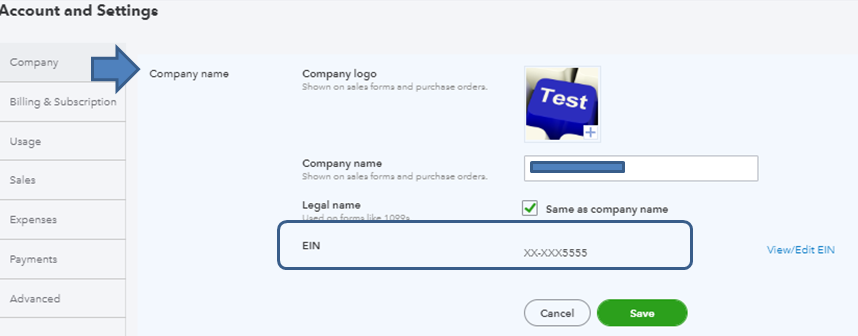

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com

2010 Payroll Taxes Recap Incurred By The Employee Incurred By The Employer

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

2022 Federal State Payroll Tax Rates For Employers

Futa Federal Unemployment Tax Act San Francisco California

What Is Sui State Unemployment Insurance Tax Ask Gusto

Suta Tax Your Questions Answered Bench Accounting

The True Cost Of Hiring An Employee In California Hiring True Cost California

How Do I Get My California Employer Account Number

A Complete Guide To California Payroll Taxes Rjs Law

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust